Starting a new company is an exciting and challenging venture, particularly in Australia, where the business environment is dynamic and ever-changing. While launching a new company can be a rewarding experience, it requires careful planning and execution to ensure success.

In this blog post, we have outlined a comprehensive checklist for starting a new company in Australia, covering everything from business registration to financing, legal requirements, and marketing strategies.

Here is a comprehensive checklist for starting a new company in Australia.

Legal requirements for starting a new company in Australia, including registering a business name and obtaining an ABN.

There are several legal requirements that must be fulfilled when starting a new company in Australia. Some of the key legal requirements include

- Registering your business name: In Australia, the regulatory body responsible for registering business names is the Australian Securities and Investments Commission (ASIC). However, there are alternative services available such as Registry Australia, which also allows businesses to register their name and provides additional services such as business name renewal and ABN registration.

By registering your business name, you ensure that no one else can use the same name for their business, and you establish your legal identity in the marketplace. This is an important step that will help you build your brand and establish your reputation in the business world. - Obtaining an Australian Business Number (ABN): An ABN is a unique 11-digit number that identifies your business to the government and other businesses. You must have an ABN if you plan to register for GST, operate as a company or partnership, or withhold taxes from payments made to employees or contractors.

- Choosing the right business structure: You must choose the right business structure for your company, such as sole trader, partnership, company, or trust. Each structure has different legal and tax implications, so it's important to choose the one that's best for your business.

- Applying for necessary licenses and permits: Depending on the nature of your business, you may need to apply for licenses and permits from various regulatory bodies, such as local councils, state governments, or federal agencies.

- Registering for GST and other taxes: If your annual turnover is $75,000 or more, you must register for Goods and Services Tax (GST). You may also need to register for other taxes, such as Pay As You Go (PAYG) withholding tax or Fringe Benefits Tax (FBT).

- Obtaining insurance coverage: Depending on the nature of your business, you may need to obtain insurance coverage, such as public liability insurance, professional indemnity insurance, or workers' compensation insurance.

These are just some of the legal requirements for starting a new company in Australia. It's important to consult with legal and financial experts such as Registry Australia to ensure that you comply with all relevant laws and regulations.

More about the legal structure of a company

When starting a new company in Australia, it's important to determine the legal structure of your company and register your business name. This step is crucial because it establishes the legal identity of your company and helps you comply with legal and regulatory requirements. The most common legal structures for companies in Australia include

- Sole Trader: This is the simplest and most common business structure in Australia. As a sole trader, you own and operate the business yourself, and you are personally liable for any debts or legal issues that arise.

- Partnership: A partnership is a business structure in which two or more people share ownership of a business. Each partner contributes to the business's operations and is responsible for any debts or legal issues that arise.

- Company: A company is a separate legal entity from its owners, known as shareholders. A company can have one or more shareholders, and its liabilities are separate from those of its shareholders.

- Trust: A trust is a business structure in which a trustee holds and manages assets for the benefit of beneficiaries. The trustee is responsible for managing the trust's operations and is liable for any debts or legal issues that arise.

Read more about whether you should choose to start as a sole trader or establish a company.

Applying for any necessary licenses and permits.

Depending on the nature of your business, you may need to apply for various licenses and permits from different regulatory bodies. For example, if you're starting a restaurant or café, you'll need to obtain food and health permits from your local council. If you're starting a construction business, you'll need to obtain building permits from your state government.

The licensing and permit requirements can vary depending on the industry and location of your business. It's important to research and identify the licenses and permits that apply to your specific business and comply with all the relevant laws and regulations.

One way to simplify the process of applying for licenses and permits is to use a service like Registry Australia. Registry Australia provides an easy-to-use platform that helps businesses register their business name and apply for licenses and permits.

Using a service like Registry Australia can save you time and ensure that you comply with all the necessary legal and regulatory requirements. The platform streamlines the process of applying for licenses and permits and provides guidance and support throughout the process. It's a great option for businesses that want to focus on their core operations and leave the legal and regulatory requirements to the experts.

Setting up a business bank account.

Setting up a business bank account involves a few key steps. First, you'll need to choose a bank that offers business banking services and open an account. You may need to provide documentation, such as your business registration and identification documents, to complete the process.

In addition to a business bank account, you may also need to consider other financial services, such as merchant services to accept payments from customers, or a line of credit or business loan to finance your operations. Your bank can provide guidance on these additional services and help you choose the ones that are right for your business.

Registering for GST and other taxes.

Registering for Goods and Services Tax (GST) is a requirement for most businesses in Australia. GST is a tax of 10% that is added to most goods and services sold in Australia, and businesses are required to register for GST if their annual turnover is $75,000 or more (or $150,000 or more for non-profit organisations).

To register for GST, you'll need to have an Australian Business Number (ABN), Once you have an ABN, you can register for GST through the Australian Taxation Office (ATO) website or by contacting the ATO directly. You'll need to provide information about your business, such as your ABN, business name, and expected turnover.

Obtaining insurance coverage.

There are several types of insurance that may be relevant for your business, depending on your industry, the size of your business, and the types of risks you face. Some common types of insurance for businesses in Australia include

- Public Liability Insurance: This type of insurance covers your business in case of claims made against you by a third party for injury or property damage caused by your business activities.

- Professional Indemnity Insurance: This type of insurance is important for businesses that provide professional services, such as lawyers, accountants, or consultants. It covers your business against claims of professional negligence or breach of duty.

- Business Property Insurance: This type of insurance covers your business property, such as buildings, equipment, or stock, against damage or loss due to events such as fire, theft, or natural disasters.

- Workers' Compensation Insurance: If you have employees, you may be required by law to have workers' compensation insurance to cover medical expenses and lost wages in case of work-related injuries or illnesses.

- Cyber Insurance: This type of insurance covers your business against cyber risks, such as data breaches, cyber-attacks, or cyber extortion.

Registry Australia offers business insurance packages to suit your needs.

Finding funding options, including grants, loans, and venture capital.

It is necessary to secure adequate funding to start and grow your business, as it provides the resources you need to invest in equipment, inventory, marketing, and other key areas.

There are several funding options available to businesses in Australia, including grants, loans, and venture capital. Here are some of the most common types of funding:

- Grants: There are many government grants available to businesses in Australia, particularly those in innovative industries such as technology, science, and research. These grants can help cover the costs of research and development, product commercialisation, and other key areas.

- Loans: Banks and other financial institutions offer a range of loan options for businesses, including business loans, equipment loans, and lines of credit. These loans can provide the capital you need to start or expand your business and can be secured or unsecured.

- Venture Capital: Venture capital firms invest in high-growth startups with the potential for significant returns. In exchange for funding, they typically take a percentage of ownership in the business and provide support and guidance to help the business grow.

- Crowdfunding: Crowdfunding platforms allow businesses to raise funds from a large number of people, typically through an online platform. This can be a useful option for businesses that have a strong online presence and a compelling story or product.

When and why you need funding will depend on the nature of your business and your goals. For example, you may need funding to cover startup costs such as equipment and inventory, or to fund research and development for a new product. Alternatively, you may need funding to expand your business or enter new markets.

Develop a website and online presence to increase your business's visibility and accessibility.

An online presence enables businesses to reach a wider audience, improve their visibility, and increase their accessibility to potential customers. This is especially important for new companies in Australia that need to establish their brand and attract customers.

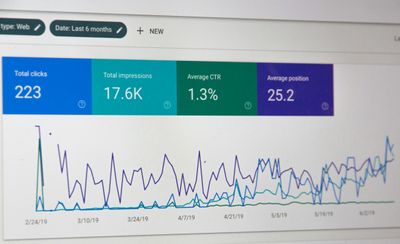

Creating a website allows businesses to provide information about their products and services, showcase their portfolio, and engage with potential customers. A well-designed website can also help build credibility and trust with customers, especially if it has a professional look and feel. Additionally, having a website can help businesses appear higher in search engine rankings, making it easier for potential customers to find them.

In addition to a website, businesses should also consider establishing a presence on social media platforms such as Facebook, Twitter, LinkedIn, and Instagram. Social media can help businesses connect with their target audience, share news and updates, and build a community of loyal customers. It's also an effective way to advertise your products and services, as social media platforms offer a range of advertising options that can be targeted to specific audiences.

If you're a new business in Australia looking to establish or enhance your online presence, consider working with Registry Australia. With their range of services, including domain registration, website hosting, website building, and online marketing, they can help you navigate the complexities of the online world and set yourself up for long-term success. Contact Registry Australia today to learn more about how they can help your business thrive online.